Motorpoint Group Plc Tax Strategy

- Home >

- Investor Relations >

- Corporate Governance >

- Motorpoint Group Plc Tax Strategy

Motorpoint Group Plc tax strategy – 26th July 2023

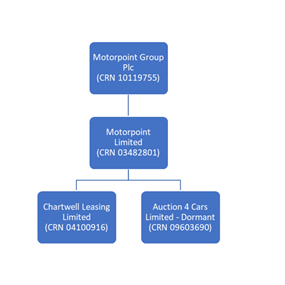

This tax strategy document covers the tax strategy for the Motorpoint Group which is headed up by Motorpoint Group Plc (the “Company” or “Group” or “Motorpoint”). The Group operates solely in the UK and is listed on the London Stock Exchange. The Group retails motor vehicles from its 20 UK based sites as well as fulfilling online and home delivery sales. The Group includes the following entities

Commitment to compliance

The Group seeks to manage its taxation obligations in the UK in compliance with applicable tax laws and regulations, ensuring that available tax incentives and allowances are utilised and recognised where it makes commercial sense to do so giving regard to the costs of making the associated claims. We act in accordance with all applicable laws at all times and are guided by relevant international standards. We aim to comply with the spirit as well as the letter of the law. We comply with disclosure requirements within required timescales.

We are committed to full compliance with all statutory obligations. We seek to comply with our tax filing, tax reporting and tax payment obligations in the UK; to ensure that the right amount of tax is paid at the right time. Whilst we seek to get things right first time we work in an environment of continuous improvement. Any inadvertent errors in submissions made to HM Revenue & Customs are fully disclosed as soon as reasonably practical.

The Chief Financial Officer is responsible for the Group’s tax strategy which is overseen and endorsed by the board of directors (the “Board”) of the Company. The Group maintains tax operating procedures and reasonable financial controls in relation to all of its tax related transactions.

Attitude toward tax planning

The Group manages tax costs through maximising the tax efficiency of business transactions. This includes taking advantage of available tax incentives and exemptions. This must be done in a way which is aligned with the Group’s commercial objectives and meets its legal obligations and ethical standards.

The Group also structures transactions in a way that gives a tax result they reasonably believe is not contrary to the intentions of the legislation concerned.

Advice is sought from external tax advisers as appropriate to support the in-house tax function in evaluating risk areas, adhering to complex tax laws and implementing best practice.

Level of tax risk accepted

The Group does not set formal quantitative risk limits in terms of levels of acceptable risk but tax risks for projects/transactions are reviewed and assessed on a case-by-case basis. The Group considers that it has a low tax risk appetite.

The Group monitors new tax legislative changes and realigns internal tax processes to be compliant when necessary. The Group actively seeks to resolve any uncertainty in the interpretation of tax legislation with HMRC.

The Group has implemented a Tax Evasion, Facilitation and Corporate Criminal Offences policy to ensure that it has reasonable prevention procedures in place to mitigate the risks posed by tax evasion and the facilitation of tax evasion and will continue to monitor and improve its response on an ongoing basis.

The Group has a zero-tolerance approach to tax evasion and the facilitation of tax evasion by any person or persons acting for or on behalf of Motorpoint.

Approach to dealing with tax authorities

We aim to engage with tax authorities, including HMRC, with honesty, integrity, respect and fairness and in a spirit of co-operative compliance. Our relationship with HMRC is managed through the relationship between the Senior Accounting Officer (SAO) and HMRC Customer Relationship Manager (“CRM”) and the business intention is to minimise the tax risk rating of the Group.

Approach to tax risk management and governance arrangements

This strategy is aligned with our Risk Management approach and is approved, owned and overseen by the Board with the day-to-day management of risks delegated to the Compliance Committee.

The Group’s tax strategy meets the requirements under Schedule 19, Finance Act 2016 in the UK and has been reviewed and approved by the Board of the Company